Architectural considerations of a new fraud detection system.

Summary

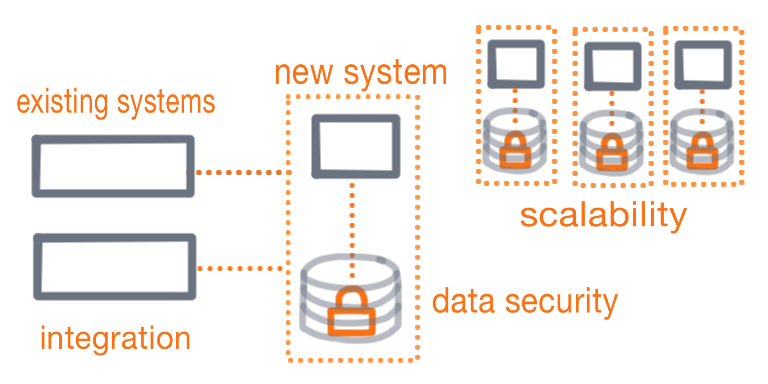

To protect their customers and to stay ahead of the fraudsters this company in the banking industry was looking for a new fraud detection system. The first step in this lengthy process is to consider the architecture of the potential new fraud detection system.

- Does the architecture fit the current way of working?

- How difficult is it to integrate this new architecture system with existing systems?

- How does this new fraud detection system scale?

- How does this new fraud detection system protects sensitive customer data?

Besides architectural considerations we also evaluated the adherence to regulatory standards and machine learning capabilities.

My role and responsibilities

As a data scientist / project lead of this first step I had a demanding list of responsibilities.

- Gather and refine the evaluation criteria for the architecture, regulatory aspects, and machine learning capabilities of the new fraud detection system.

- Define, plan, and chase all user stories to successfully finish the project in time.

- Gather, discuss, and translate highly specialized evidence gathered by the solution architects, legal colleagues, and data scientists.

- Organize and lead meetings with specialists, upper management, and vendors of potential new fraud detection systems.

- Gather and transform input data for potential new fraud detection systems, and test and evaluate the systems for business value.

- Build a clear and concise presentation with the translated evidence so that the main stakeholders can make an informed decision about which architecture would fit best.

An important personal learning on this project is that hands-off projects can be just as interesting as hands-on.